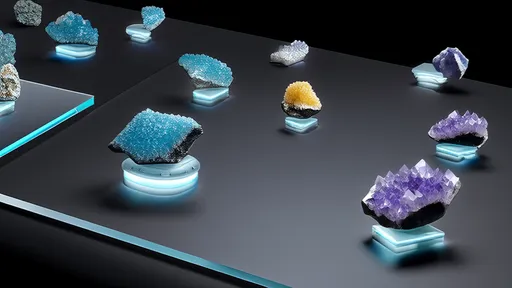

The global gemstone trade is undergoing significant regulatory changes as major mining countries implement new direct-purchasing protocols for rough stones. These measures aim to streamline cross-border transactions while combating illegal mining and smuggling operations that have plagued the industry for decades. At the heart of these reforms lies a delicate balance between facilitating legitimate commerce and enforcing stricter chain-of-custody documentation.

African nations leading the charge have begun requiring digital mineral passports for all exported rough diamonds and colored gemstones. Tanzania recently launched its Blockchain-based certification system, creating immutable records from mine to marketplace. "This isn't about adding bureaucracy," explains Geoffrey Mwale, Tanzania's Minister of Mineral Resources. "We're building trust through transparency - when buyers know exactly where their stones originated, everyone wins." The system has already reduced smuggling incidents by 37% in its first quarter of operation.

South America's emerald trade faces unique challenges under the new regulations. Colombian authorities now mandate that all rough emerald parcels exceeding 50 carats undergo spectroscopic fingerprinting before export. This creates optical signatures that can be matched to specific mining concessions. Brazilian regulators took this concept further by implementing micro-laser inscriptions visible only under magnification. "The inscription includes GPS coordinates of the mine and date of extraction," says Rio de Janeiro customs official Carla Mendes. "We've intercepted three shipments with falsified origins since January."

Asian markets are responding with mixed reactions to these changes. While Thailand's gem cutting centers welcome the increased legitimacy, some smaller operations struggle with compliance costs. The Bangkok Gem and Jewelry Association recently hosted workshops explaining how to verify the new documentation. "Proper paperwork actually speeds up customs clearance," notes association president Voravit Techavijit. "Our members processing certified stones see 40% faster turnaround at Suvarnabhumi Airport."

European Union import protocols now require dual verification - matching physical stones to their digital certificates while confirming the miner's export license remains valid in real-time. Antwerp's diamond district has adapted quickly, with most major dealers upgrading their verification labs. "We installed LIBS spectrometers that can authenticate a stone's origin in 90 seconds," shares De Beers veteran Marc Van de Velde. "The technology pays for itself by preventing seven-figure mistakes."

North American retailers face pressure to document their supply chains more thoroughly. The U.S. Jewelry Council recently published guidelines for maintaining "mine-to-market" records that survive customs audits. Tiffany & Co. now includes blockchain IDs on high-value gem certifications. "Customers appreciate knowing their sapphire didn't fund conflict," remarks CEO Anthony Ledru. "The extra documentation becomes a selling point."

Australian opal miners pioneered an unexpected solution - embedding nanoparticles containing mining license data directly into rough stones. The microscopic tags don't affect gem quality but provide foolproof identification. "We're licensing the technology to Canadian jade producers," says Perth-based inventor Dr. Eleanor Chang. "The particles glow under specific frequencies - customs agents love how quickly they can verify shipments."

These regulatory shifts create new opportunities for ethically sourced gems. Mines complying with international labor and environmental standards report premium pricing for their certified rough. "Our rubies now command 22% over market," says Mozambique's Gemfields representative Isabel Nkosi. "Buyers pay more knowing children didn't dig these stones." The Kimberly Process Certification Scheme plans to incorporate many of these new tracking methods into its 2025 guidelines.

Logistics providers have emerged as unexpected beneficiaries. DHL and FedEx now offer "white glove" gem shipping services with humidity-controlled containers and armed transport for high-value parcels. "We trained 300 specialists in the new documentation requirements," says DHL's precious cargo director Henrik Sørensen. "Proper paperwork means fewer delays - our compliant shipments clear customs 65% faster."

Despite progress, challenges remain. Artisanal miners in Madagascar struggle with the cost of compliance, while some Indian cutters resist sharing profit data with upstream suppliers. The World Bank has launched a $50 million fund to help small operators adopt tracking technologies. "Inclusivity is crucial," stresses project manager Rajiv Kapoor. "If only corporate mines can afford compliance, we'll push legitimate small miners into the black market."

The changes extend beyond paperwork - they're reshaping industry relationships. Miners now negotiate directly with manufacturers, bypassing traditional intermediaries. "We video call cutting factories to show them rough parcels still in the ground," says Zambia's emerald miner Joseph Banda. "They commit to purchases before we even extract stones." This direct trade reduces price speculation and ensures fairer compensation for mining communities.

Consumer awareness campaigns are amplifying these reforms. The Responsible Jewellery Council's new "Know Your Gem" initiative educates buyers about asking for origin documentation. Major auction houses now require provenance records for all gem lots. "A Burmese ruby without proper papers sells for 30% less," notes Christie's jewelry head Rahul Kadakia. "The market is voting for transparency."

Technology providers race to develop better verification tools. Startups like GemTrace and MineLedger offer affordable blockchain solutions for smaller miners. De Beers' "Tracr" platform now tracks over 60% of global diamond production. "We're moving toward an industry where every facet of every gem tells its true story," predicts Tracr CEO Gareth Penny. "The stones themselves will become their own certificates."

These reforms arrive as generational change sweeps the trade. Younger buyers demand ethical sourcing, while tech-savvy miners embrace traceability. "My grandfather mistrusted paperwork," smiles third-generation Colombian emerald dealer Santiago Lopez. "I sleep better knowing my inventory won't be confiscated at customs." As dawn breaks on this new era of transparency, the gem trade appears ready to shed its murky past for a more accountable future.

By /Aug 19, 2025

By /Aug 19, 2025

By /Aug 19, 2025

By /Aug 19, 2025

By /Aug 19, 2025

By /Aug 19, 2025

By /Aug 19, 2025

By /Aug 19, 2025

By /Aug 19, 2025

By /Aug 19, 2025

By /Aug 19, 2025

By /Aug 19, 2025

By /Aug 19, 2025

By /Aug 19, 2025

By /Aug 19, 2025

By /Aug 19, 2025

By /Aug 19, 2025

By /Aug 19, 2025

By /Aug 19, 2025

By /Aug 19, 2025